Council has a 10-year plan for the Bellingen Shire to ensure our future is secure over the long term and is providing quality services to our community. For Council to achieve this, we need to live within our means while balancing the delivery of the best possible services.

Council only has a limited amount of funding to continue delivering our services and maintain our infrastructure. Despite our best efforts to become more financially sustainable, costs continue to rise faster than our income.

We understand that our community places a high value on access to quality services, vibrant places and inclusive events that contribute to our connectedness and sense of wellbeing.

While we know that a rate rise is never welcome, we believe it is an important conversation that we need to have within our community. Council has conducted extensive community consultation to gather feedback on a proposal to apply to the Independent Pricing and Regulatory Tribunal (IPART) for a Special Rate Variation (SRV).

We encourage you to read through this important information to understand why we are considering this application to IPART.

Special Rates Variation Calculator

The rates calculator helps rate payers understand the amount the Special Rate Variation will have on specific home and land owners. It has been updated to include the 2024 Land Values and has been simplified for use. The information you will need is the assessment number from your rates bill and whether you are eligible to receive the pensioner subsidy.

View the Rates Calculator(XLSX, 1MB)

Drop in Sessions

As part of Council's community engagement program, residents and ratepayers were invited to attend drop in sessions where they were able to speak directly with Council staff and Councillors regarding the Special Rate Variation. Drop in sessions were held in the following locations:

Dorrigo

This session was held at:

Dorrigo Community Hall (36 Hickory Street, Dorrigo) on Wednesday 18 January 2023 from 4pm - 6pm.

Urunga

This session was held at:

Urunga Literary Hall (Bowra Street, Urunga) on Thursday 19 January 2023 from 4pm - 6pm.

Bellingen

Two sessions were held in Bellingen:

Bellingen Uniting Church Hall (Hyde Street Bellingen - across from Council).

Session 1 was held on Friday 20 January 2023 from 8am - 10am.

Session 2 was held on Monday 23 January 2023 from 5pm - 7pm.

Ratepayers were encouraged to bring along their rates notification to these sessions to assist in determining what the Special Rate Variation would mean for them.

Explaining Special Rate Variations and Rate Pegs

What is a rate peg or cap?

The Independent Pricing and Regulatory Tribunal (IPART) is required to set the maximum percentage amount by which councils can increase their general income each year. This ceiling is known as the rate cap or rate peg.

How is the rate peg set?

Councils have no say in how the rate peg is set. Prior to 2010, the Minister for Local Government set the rate peg. Since then, the rate peg is set by IPART and is mainly based on the Local Government Cost Index (LGCI).

The LGCI measures price changes over the previous year for the goods and labour an average council will use. IPART also look at productivity changes over the same period.

What is a Special Rate Variation?

A Special Rate Variation allows a council to increase its general income above the rate cap, under the provisions of the Local Government Act 1993 (NSW). Special Rate Variations can be for one or several years and can be temporary or permanently retained in the rates base. Each year, councils wishing to apply for a Special Rate Variation do so to IPART in February. The applications are assessed against criteria listed in the Office of Local Government’s guidelines.

These include undertaking long-term financial planning, ensuring community awareness of the need and extent of the proposed increase in rates, and consideration of the impact on ratepayers and the community’s capacity and willingness to pay. In addition, councils must meet criteria related to productivity improvements. For more information on Special Rate Variations, refer to IPART’s website.

What is being proposed under the Special Rate Variation?

IPART has set a rate peg of 4.5% for Bellingen Shire Council in 2023/24. Under the Special Rate Variation, Council is considering a four year permanent Special Rate Variation.

The first two years of the special variation would see a rate increase of 8% (including the rate peg of 4.5%), followed by two years of 6% (including the rate peg - not yet determined) Should the application be successful, this would start from the 2023/24 financial year through to 2026/27.

Explaining why a Special Rate Variation is being considered

Why is a Special Rate Variation proposed?

The decision by Council to begin this engagement process was made following careful consideration and financial modelling, which highlighted the ongoing impacts of global inflationary pressures such as elevated oil prices and supply chain disruptions.

Bellingen Shire Council has experienced significant increases to the costs associated with delivering services that will meet the expectations of our community.

The impact has been felt across several areas including significant cost increases to fuel, insurance premiums, electricity, heating, emergency services levy and employee costs.

Where will the additional revenue be spent?

Bellingen Shire Council is responsible for over $0.5 billion worth of assets and delivers over 50 unique services to our community.

The additional income generated as part of the proposed Special Rate Variation will be used to offset the rapidly rising costs associated with maintaining the assets Council is responsible for and delivering services that will meet the expectations of our community.

How long is the proposed Special Rate Variation for?

If approved, the Special Rate Variation would be a permanent. The proposed increase would be 8% (including the rate peg) for 2023/24 and 2024/25, followed by 6% (including the rate peg - not yet determined) in 2025/26 and 2026/27.

What happens if we don't apply for a Special Rate Variation?

Council will have to consider its ongoing financial sustainability and may have to look at options to reduce the levels of service the community has come to expect.

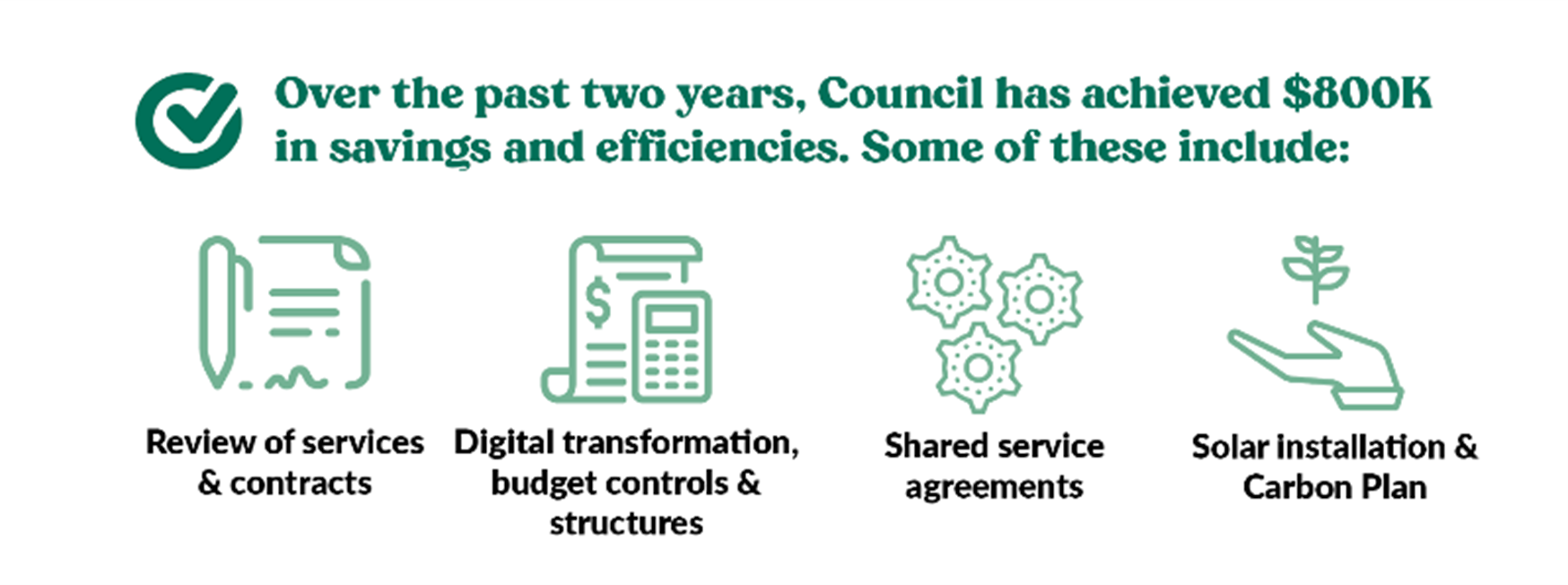

What has Council done to be more efficient?

A Special Rate Variation is not the only option that Council has considered to improve its overall financial performance and better manage its service delivery.

Council has identified a number of budgetary savings and operational efficiencies facilitated through its Financial Sustainability Strategy and Action Plan.

Explaining how a Special Rate Variation will impact ratepayers

How will a Special Rate Variation affect my rates?

Should this special rate variation be approved, the estimated impact to a residential ratepayer will be an additional $2.09 per week in the first year, $2.26 per week in the second year, $1.83 per week in the third year and $1.94 per week in the fourth year.

The proposed Special Rate Variation to address inflationary pressures is estimated to have the following impact on the rating categories:

Explaining how Council is engaging with the community

Why is Council consulting over the Christmas and January holiday period?

The time frame has been set by the Office of Local Government and IPART guidelines, however Council has been successful in an extension to the application due date which will support extended consultation timeframes.

How is Council engaging?

It is a requirement of IPART that any council making an application for a Special Rate Variation undertake a program of communication and engagement with its community.

Council is currently engaging with our residents through a number of avenues including:

- Letterbox drops

- Newspaper ads

- Media releases

- Fact sheets

- Community newsletters

- SV ‘One Stop Shop’ online engagement tool

- Documentation on public exhibition

Drop-in Sessions

Residents were invited to attend a drop-in session earlier this year to speak directly with Council staff regarding the Special Rate Variation.

Drop-in sessions were held in the following locations:

Ratepayers were encouraged to bring along their annual rates notification to assist with calculating how the Special Rate Variation may impact their rates.

How can I have my say?

The community consultation period has now closed. Community members were able to complete a survey regarding the proposed Special Rate Variation up until 31 January 2023. Feedback was also received at the drop-in sessions, and in writing to Council.

What other information is available to me?

Supporting information can be accessed through the Independent Pricing and Regulatory Tribunal (IPART) website, including a range of relevant resources such as the Engaging with IPART on 2023-24 special variation applications factsheet and the For Ratepayers page.

Explaining concessions and our financial hardship policy

As a pensioner, am I eligible for a concession / rebate on my rates?

Concessions are available for eligible pensioners. To be an eligible pensioner you must receive a pension from either Centrelink or the Department of Veterans’ Affairs, and be entitled to a pensioner concession card issued by the Commonwealth Government. You can only claim a concession on the property if it is the sole or principal place you live.

How do you apply for a pensioner concession?

You need to complete a pensioner concession application form. This can be downloaded from the Council website by clicking here.

If you are eligible, what concessions are you entitled to?

Pensioners are entitled to up to half of the total of your ordinary rates and domestic waste management service charge, up to a maximum of $250. In addition to this, pensioners are also entitled to up to half of their water rates or charges, up to a maximum of $87.50 and up to half of their sewerage rates or charges, up to a maximum of $87.50.

What if I can’t pay my rates?

Bellingen Council recognises that ratepayers may at times experience difficulty in paying rates and charges. Council has a Hardship Policy in place to provide assistance to ratepayers who are experiencing genuine difficulties with the payment of their rates and charges.

The Hardship Policy requires ratepayers to be means tested and make an application for a formal payment arrangement. Once the payment arrangement has been finalised, Council may also remove any interest accrued should this contribute to any additional hardship.

For more information regarding assistance with paying your rates, click here.

The Special Rate Variation survey is now closed